Freedom From All Taxes Upon The Natural Born State Citizen

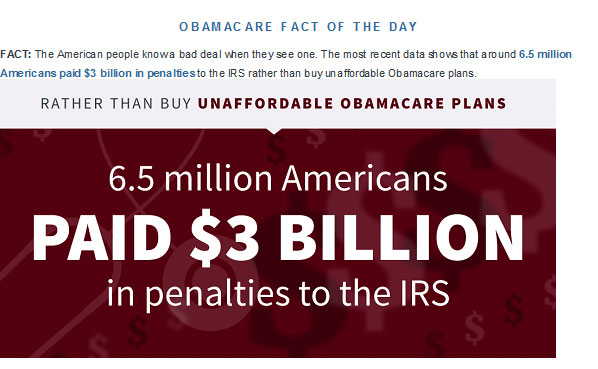

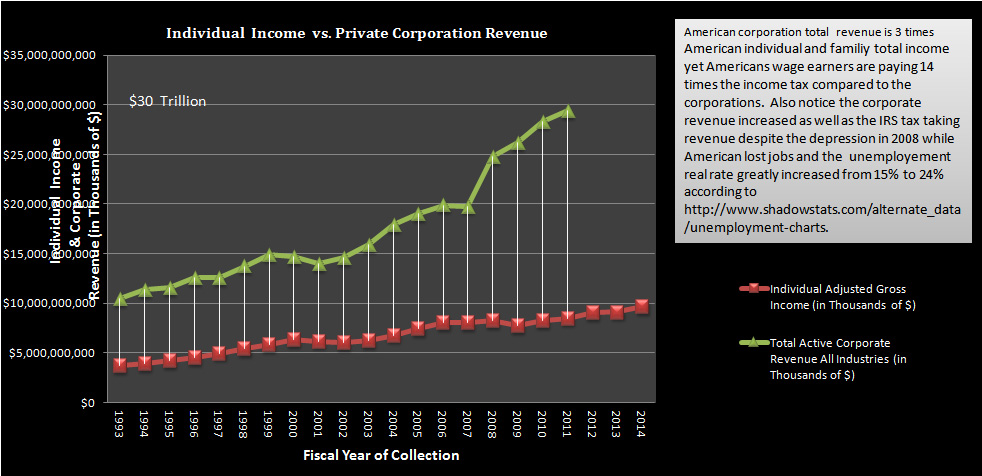

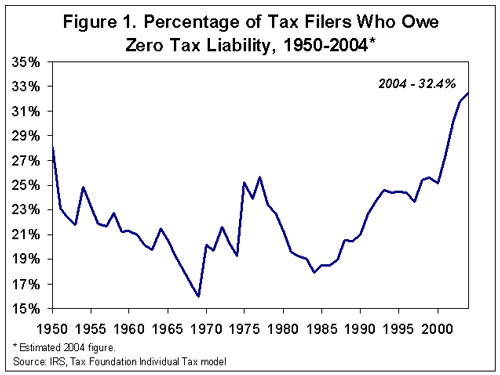

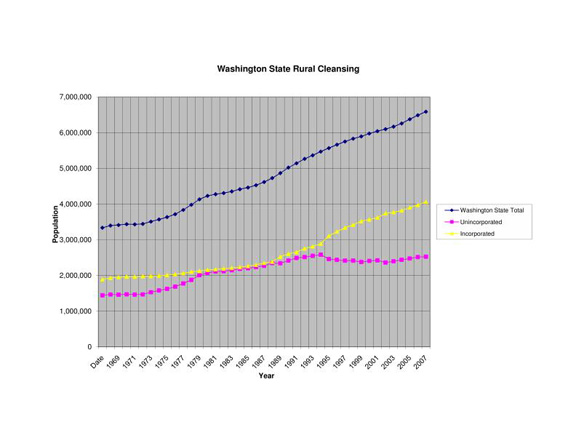

Do You Get the Picture Now?

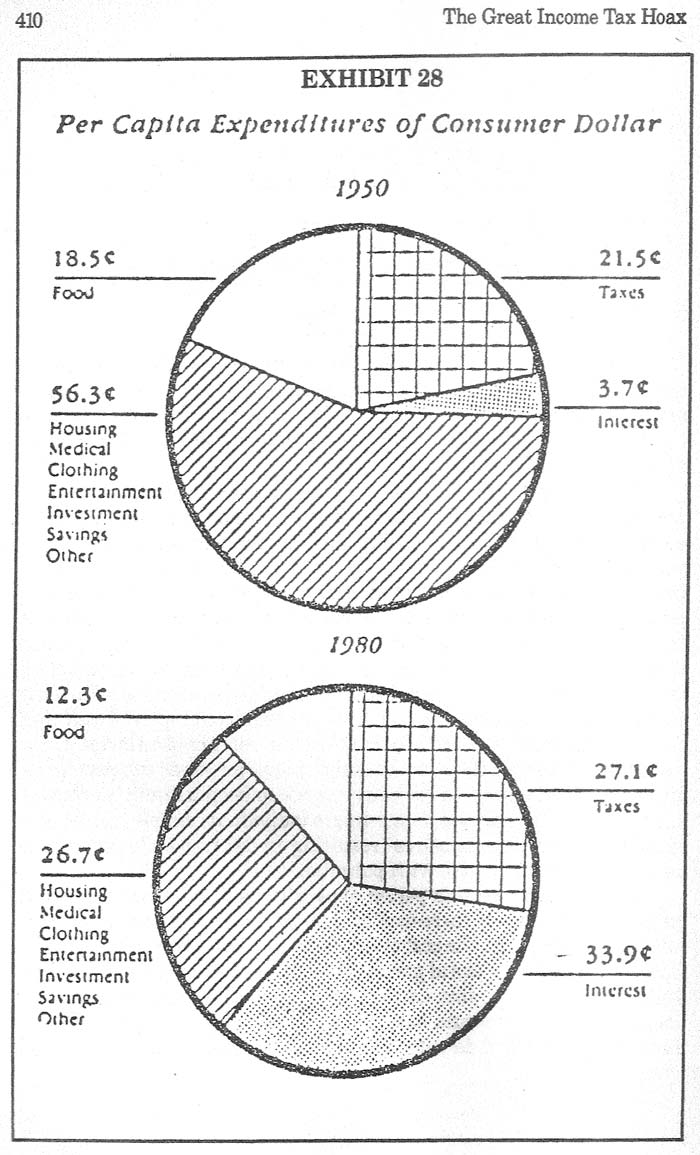

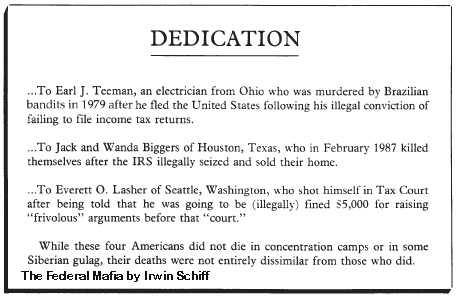

The Great Income Tax Hoax - Irwin Schiff

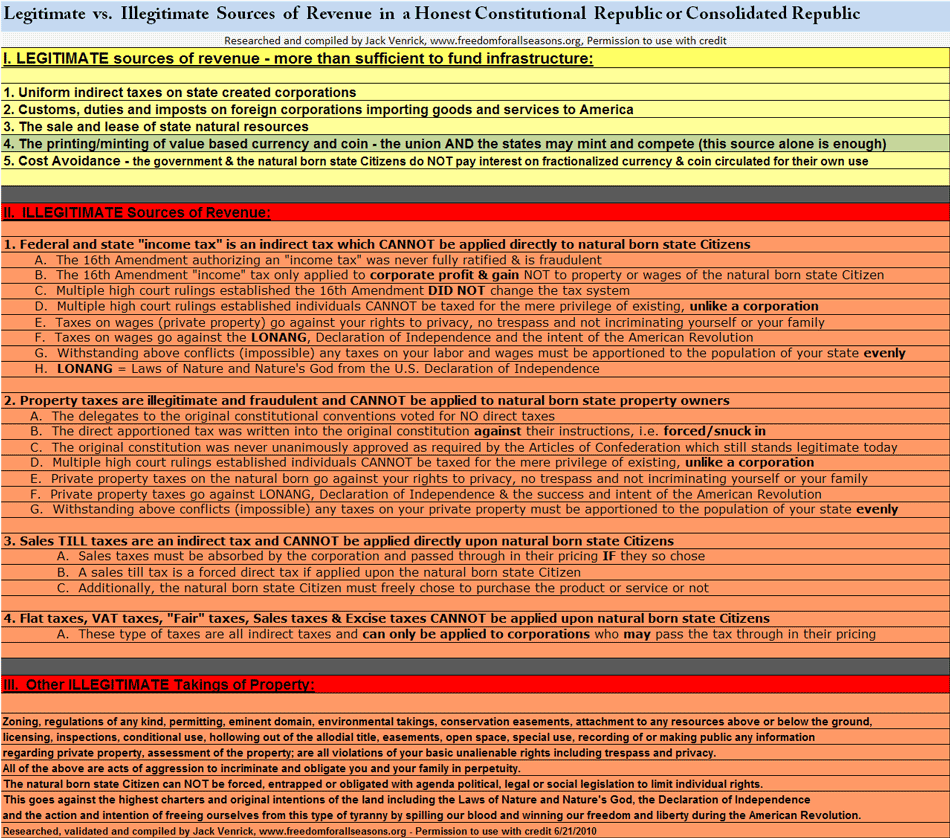

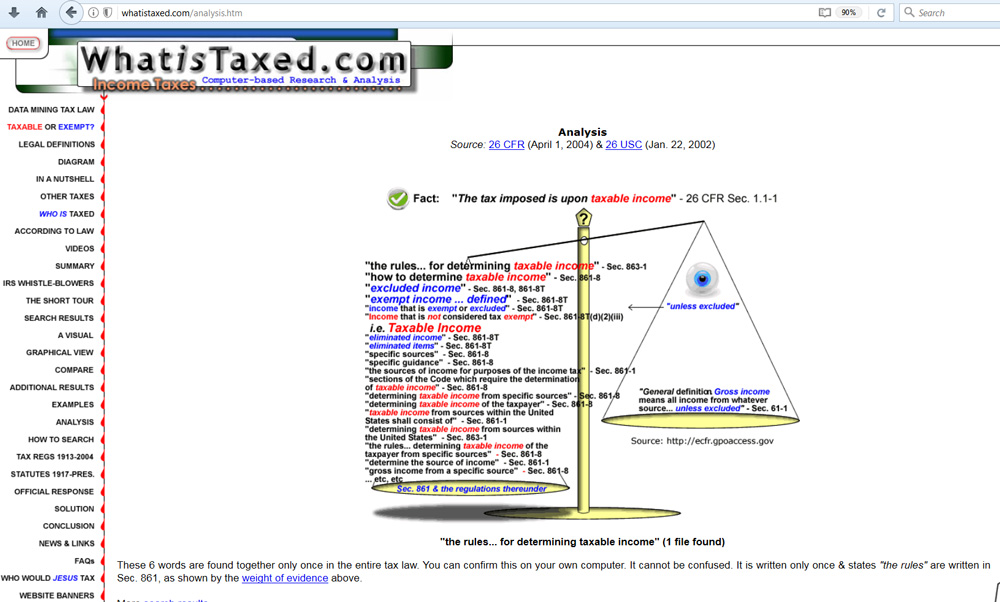

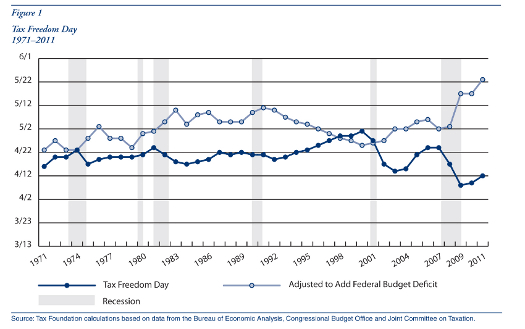

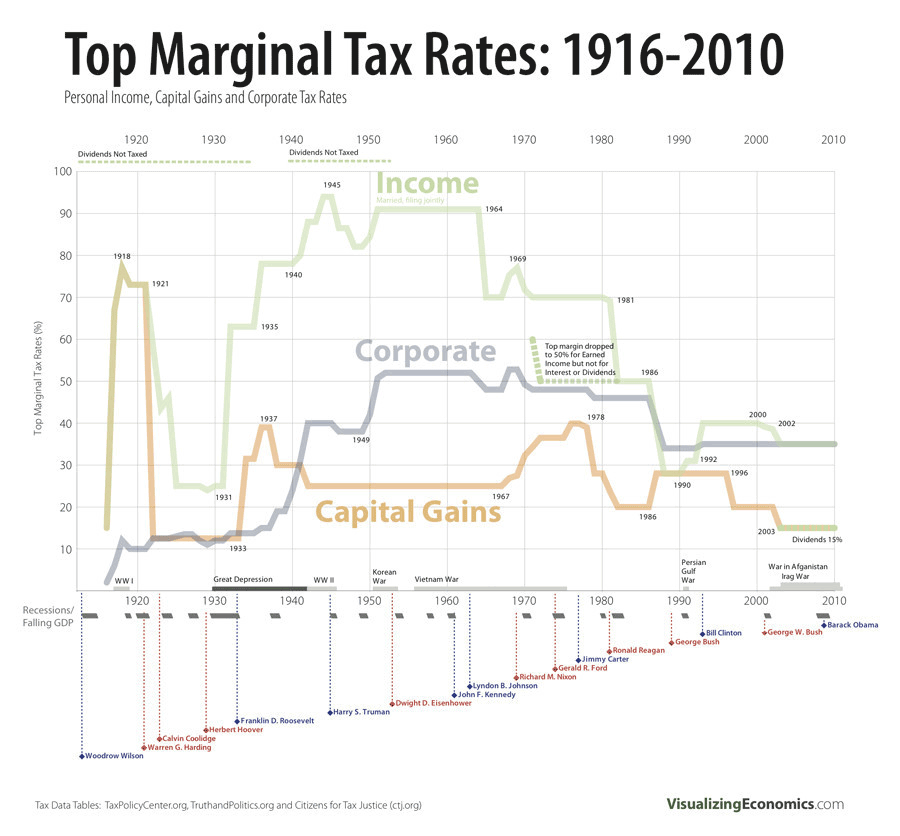

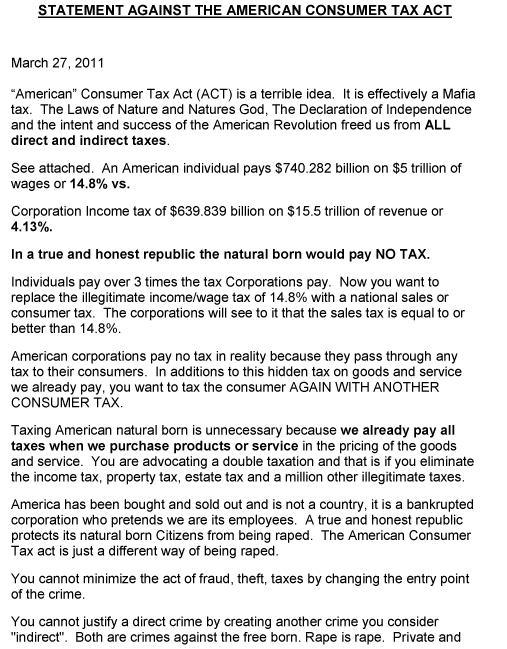

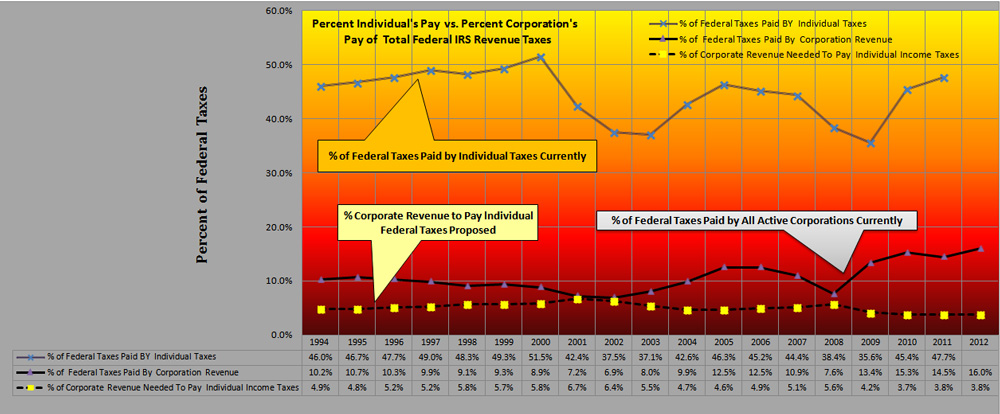

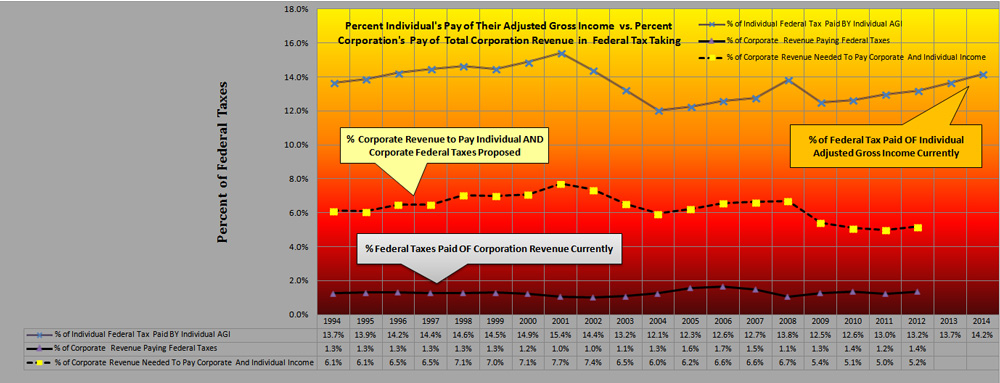

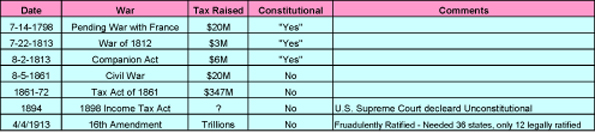

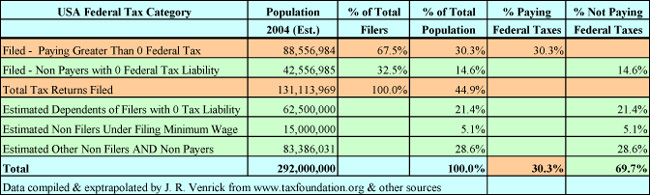

Please Click on Table to View Full Size

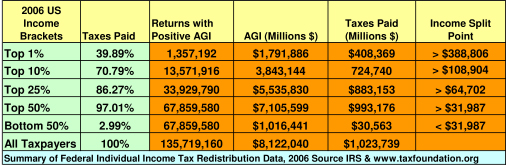

The Great Income Tax Hoax - Irwin Schiff

Jesus Christ Statements AGAINST Taxes

Click on Republic Magazine Cover for PDF Copy

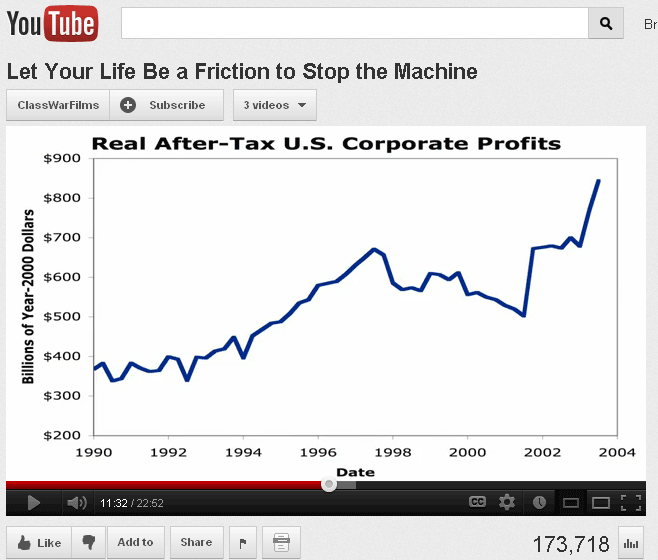

Must See Documentation, Articles and Video

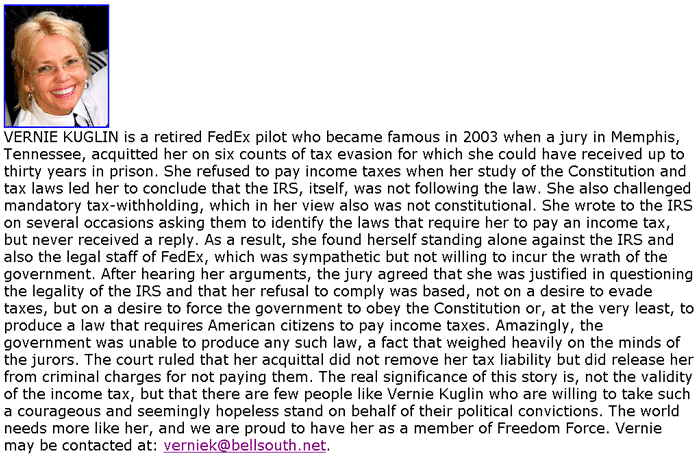

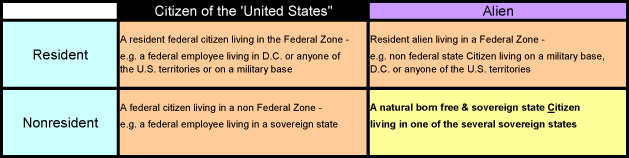

1. The taxing of wages, i.e. private property, goes against:

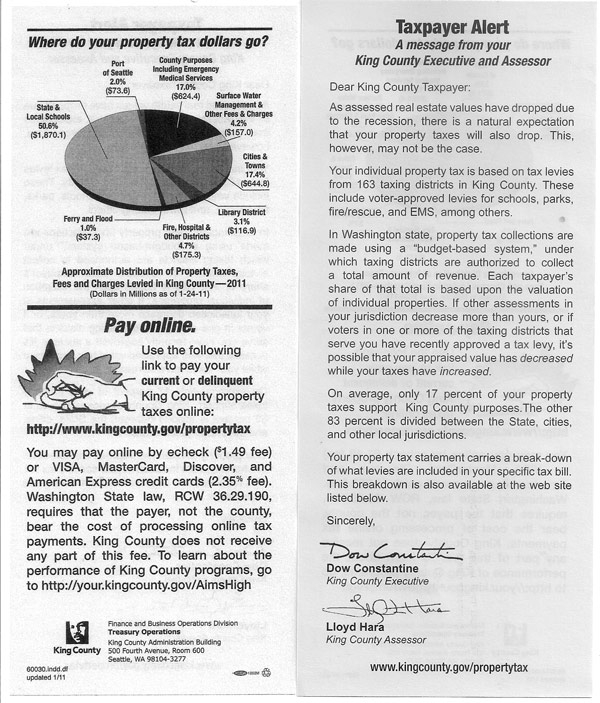

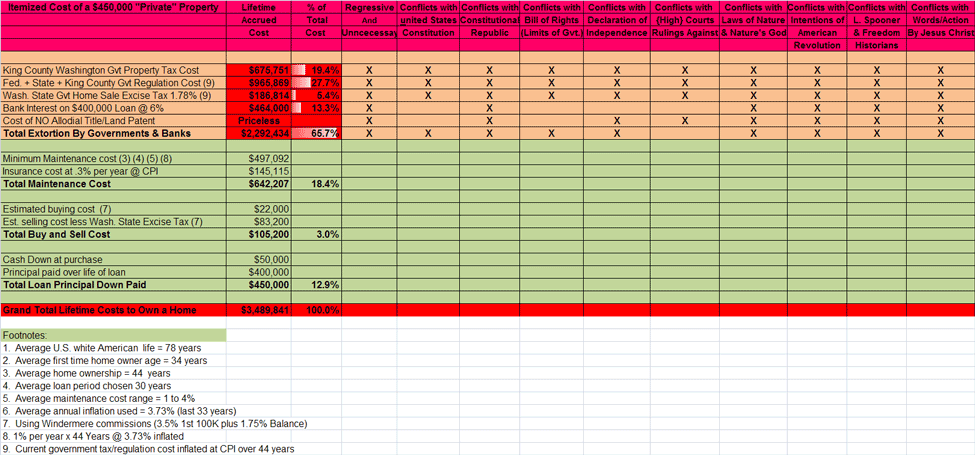

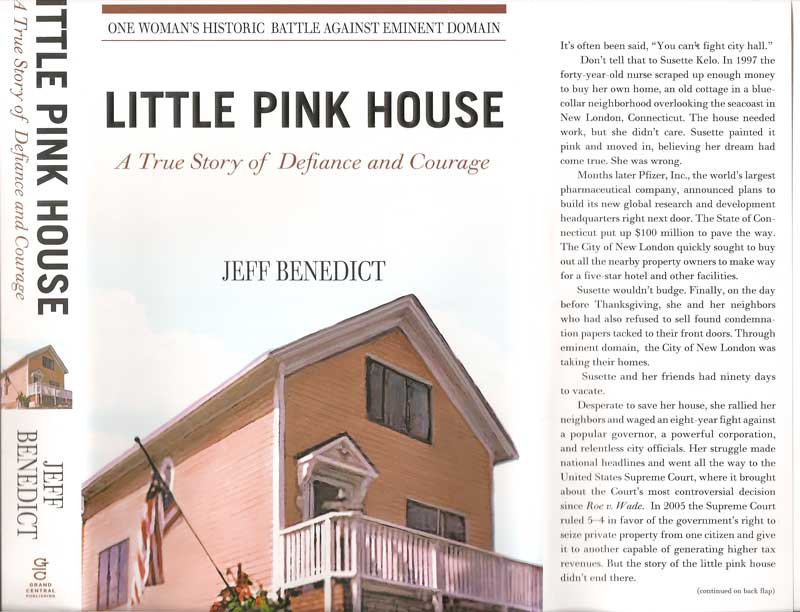

2. The taxing of physical private property goes against:

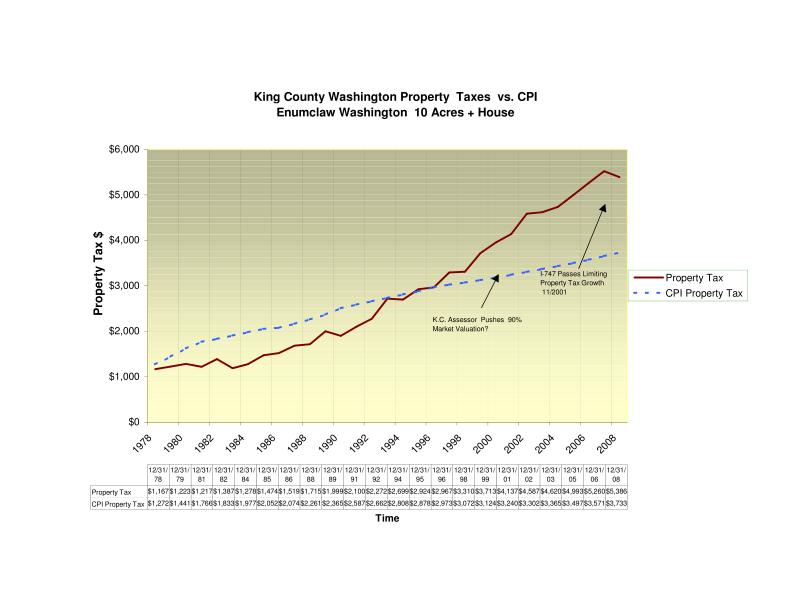

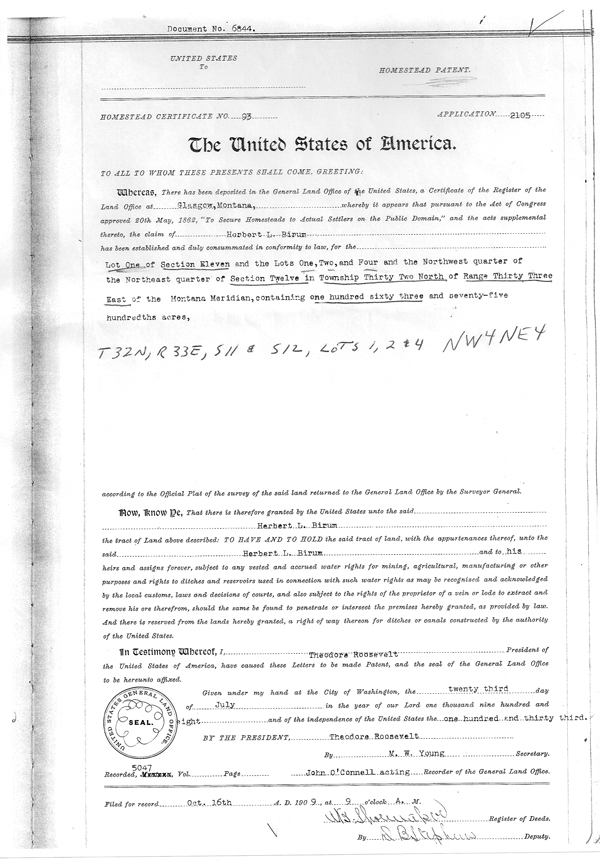

The extortion of $88,210 of unconstitutional & unnecessary property taxes over 31 years

3. The taxing of private property by restricting its use goes against:

4. The charging of a sales TILL tax directly on the natural born state Citizen is fraudulent

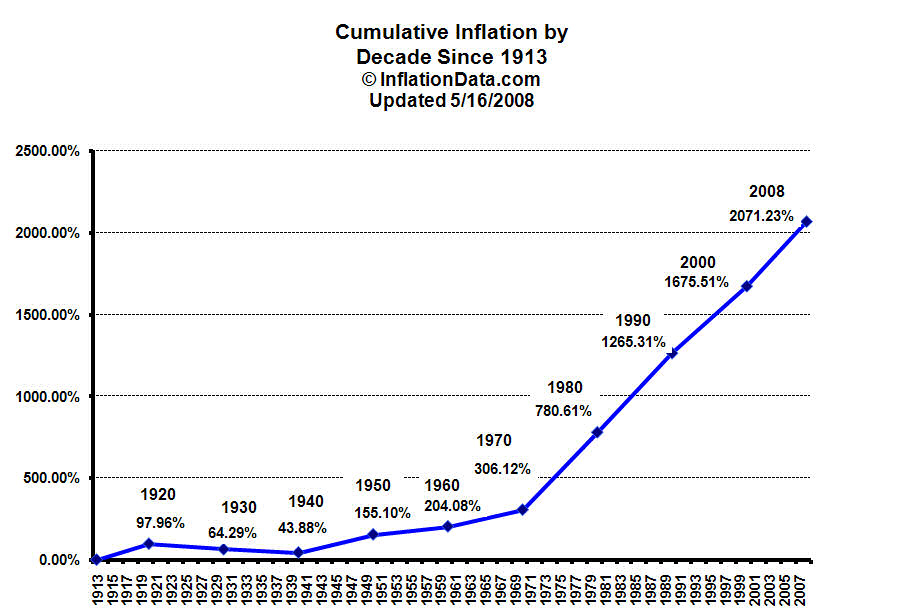

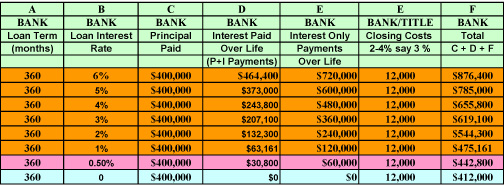

5. The charging of bank interest for private property is usury and goes against :

6. Cost of private property stolen from an average house & land over a lifetime

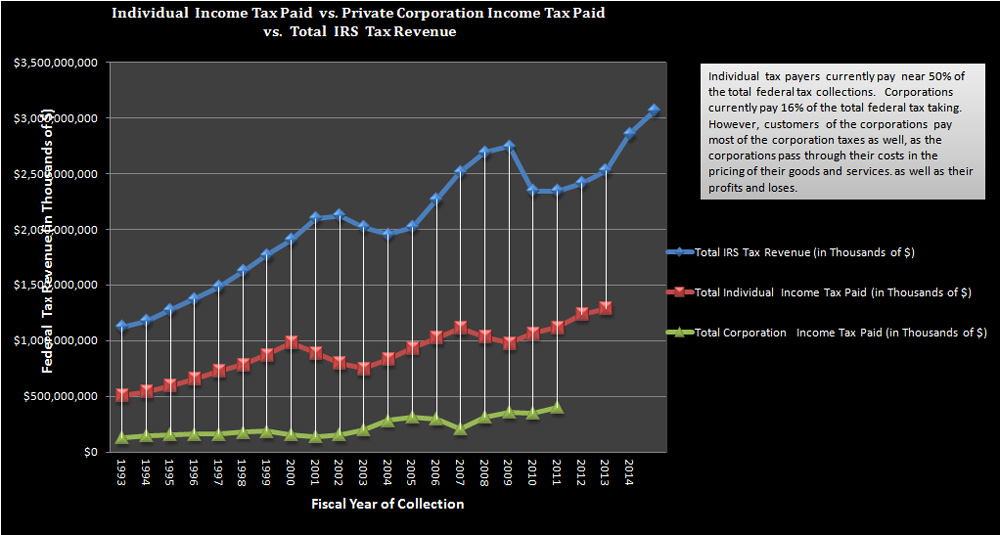

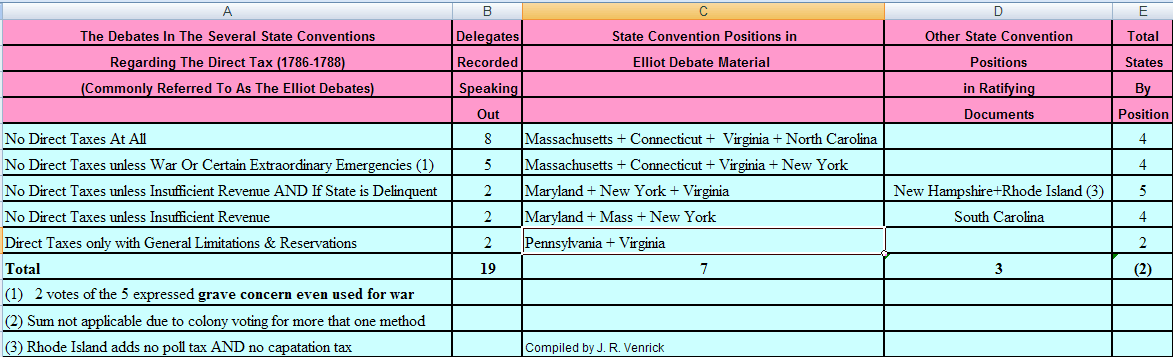

Please click on table to see Excel chart clearly

7. The taking of allodial title goes against:

8. Are you a Nonresident Alien in the United States of America?

Check out this brilliant work https://www.supremelaw.org/fedzone11/index.htm

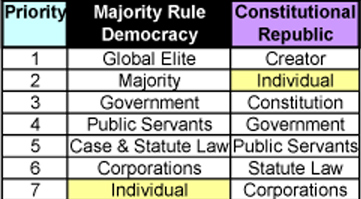

9. Do you live in a Constitutional Republic or a Democracy?

2012 Postings

2011 Postings

2010 Incoming/Outgoing

2009 Incoming/Outgoing

Archived

|

Click on your hat & saddle & spurs to ride back Home Partner

Compiled by Jackranch

The Ranch At Freedom For All Seasons BarJRV

jacksranch at freedomforallseasons dot org